Many investors panic when the market drops suddenly. This fear is natural because losing hard-earned money feels painful. But history and smart strategies prove that downturns are not permanent. With wealth management services, investors can handle uncertainty with confidence. These services focus on guiding people with the right strategies, so they don’t lose direction during tough times. Also, advisors like Glorious Path can help people see opportunities even when markets look risky.

What Are Stock Market Corrections?

Stock market corrections happen when prices fall sharply for a short time. They sound scary, but they are common. To understand better:

- A correction usually means a 10% or more fall from recent highs.

- They happen because of investor fear, global events, or policy changes.

- Corrections don’t always mean a crash, but they test patience.

- They can create good entry points for disciplined investors.

So, if you know the meaning of corrections, you can plan smarter. With long term financial planning, these dips are not threats but steps toward steady growth.

History Shows Markets Always Rebound

When we look at history, corrections never lasted forever. Big recoveries followed. Examples include:

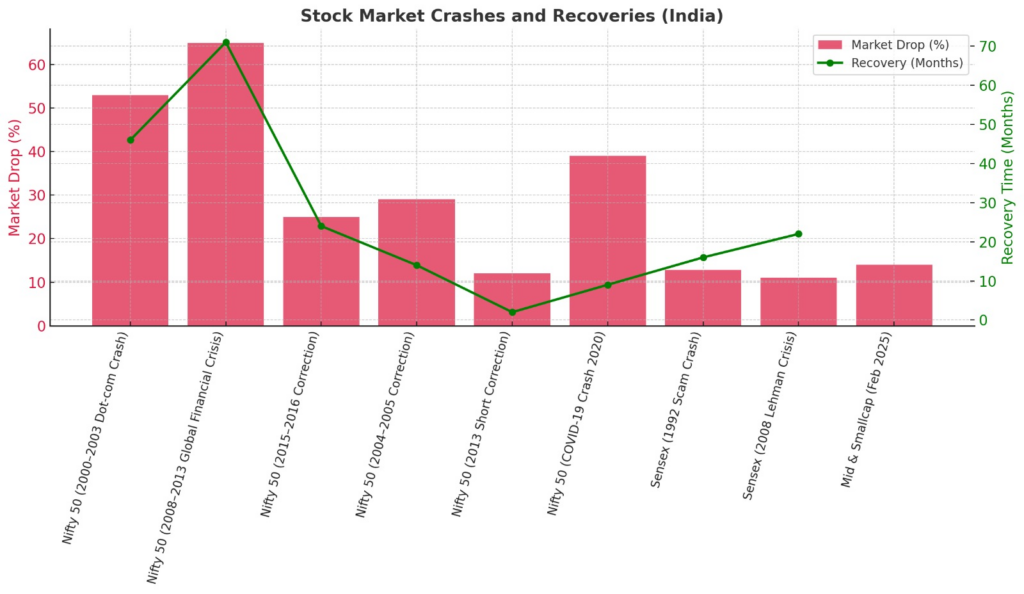

Nifty 50 (2000–2003 Dot-com Crash): After a 53% drop, the index took nearly 46 months to recover.

Nifty 50 (2008–2013 Global Financial Crisis): Markets corrected ~65%, but eventually rebounded in about 71 months.

Nifty 50 (2015–2016 Correction): The index fell nearly 25%, followed by a recovery over the next 24 months.

Nifty 50 (2004–2005 Correction): Witnessed a 29% drop, but bounced back in 14 months.

Nifty 50 (2013 Short Correction): Slipped around 12%, and regained levels in just 2 months.

Nifty 50 (COVID-19 Crash 2020): Nifty dropped ~39% but staged a strong rebound within 9 months.

Sensex (1992 Scam Crash): Lost ~12.8% and recovered in about 16 months.

Sensex (2008 Lehman Crisis): Plunged ~11% in a single day, but markets recovered within 22 months.

Mid & Smallcap (Feb 2025): Currently facing a 10–14% drop; recovery is still ongoing.

Same As We found in the US stock market also

Dot-com Bubble (2000–2002): The S&P 500 fell nearly 47% but rebounded by 33% within a year.

Global Financial Crisis (2007–2009): After a 55% crash, markets surged 70% in the next 12 months.

COVID-19 Crash (2020): Stocks dropped 34% in just 1.5 months, but recovered with a 74% rally within a year.

This means that stock market crashes and rebounds always happen, whether it is the Indian market or foreign markets. Indian markets also proved resilient. Nifty corrections above 10% saw a 32% rise in 6 months and 57% in 12 months. These examples remind us that markets always recover. With financial planning support and wealth management services, investors can ride out downturns instead of panicking.

Lessons Investors Can Learn from Market Crashes

Corrections teach important lessons that shape smart investing. Some key points include:

- Timing the market is risky; staying invested matters more.

- SIPs during corrections help buy more units at lower prices.

- Diversification reduces stress because all assets don’t fall together.

- Policy support, like India’s ₹20 lakh crore COVID package, can trigger fast recovery.

Because of these lessons, wise investors see corrections as part of the journey. They also focus on financial security instead of short-term fears.

Why Market Corrections Are Opportunities, Not Threats

Corrections are not just falls; they are hidden chances to grow. Investors who think long-term can benefit:

- Lower prices create entry points for quality stocks.

- SIPs and disciplined investing lead to higher returns after recovery.

- Portfolio rebalancing ensures alignment with goals.

- Strong companies bounce back faster, so corrections filter out weak players.

Therefore, corrections are doors to long-term growth. With safe investment options, guided investors can use dips as stepping stones instead of setbacks.

How Wealth Management Services Keep You Protected

This is where guidance plays the biggest role. Market volatility is unpredictable, but staying protected is possible when experts are by your side. Glorious Path helps investors with the following:

- Building strategies for every cycle, so panic never rules decisions.

- Offering systematic investment plans that use downturns to benefit.

- Balancing portfolios regularly to reduce risks and ensure discipline.

- Suggesting long-term wealth creation tools beyond just stocks.

Because of that, investors feel secure even when markets turn rough. In 2025, volatility will always remain a reality, but smart investing can turn risk into reward. That’s why investment planning services and wealth management services from advisors like Glorious Path are so valuable today.